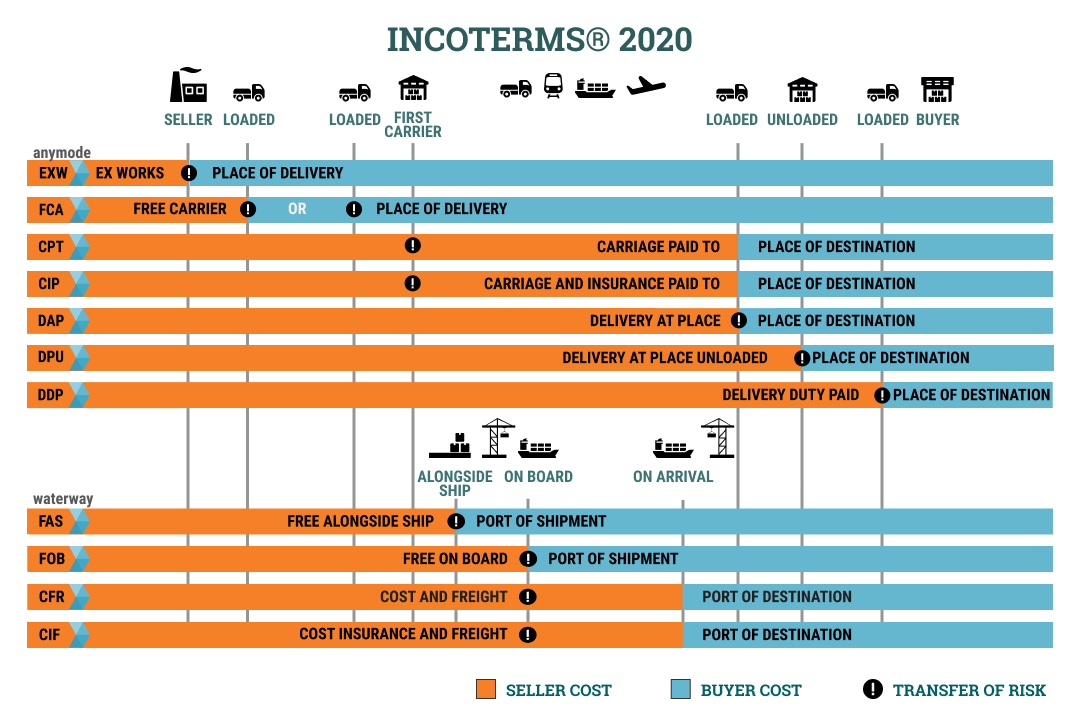

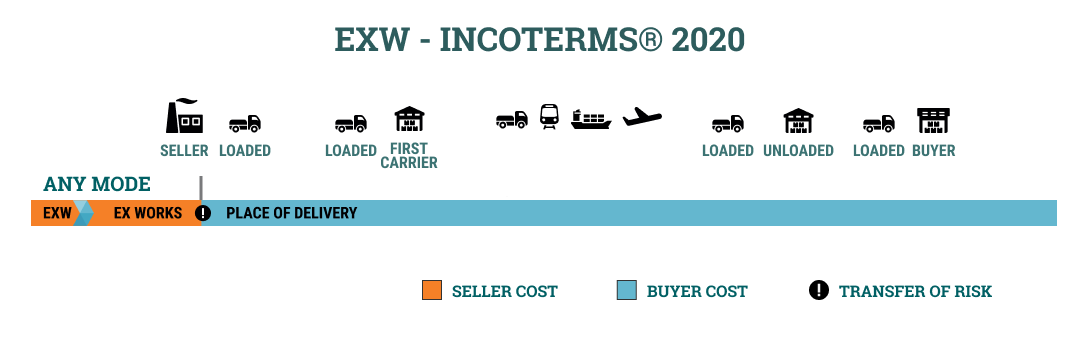

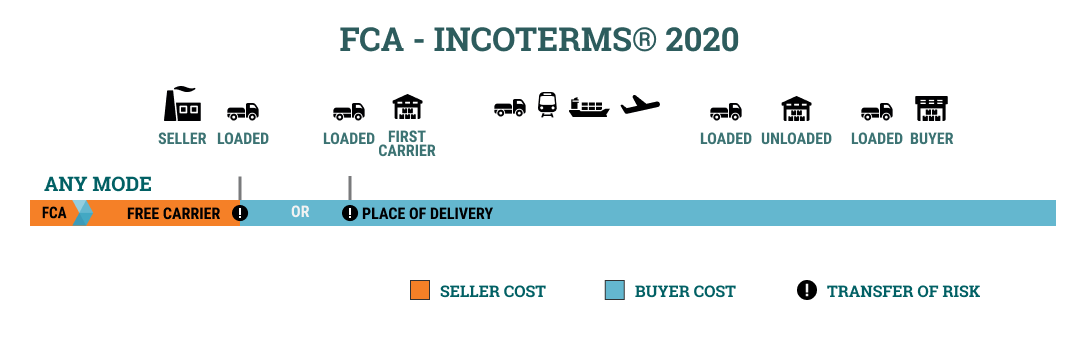

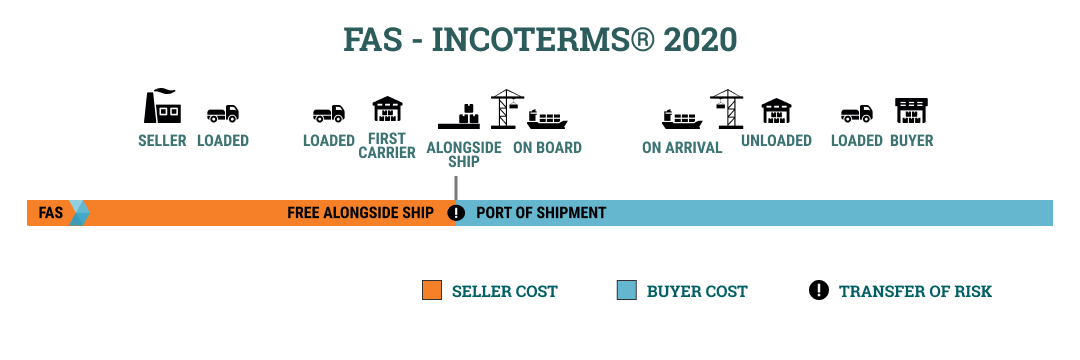

International commercial transactions often face uncertainties and discrepancies between different countries’ regulations. To reduce these uncertainties, the International Chamber of Commerce created the Incoterms, a set of 11 rules that outline the rights and obligations of both the buyer and the seller in a contract of sale in terms of the delivery of goods. These rules do not replace the sales contract but help to clarify the responsibilities of each party.

It is essential to understand that Incoterms rules do not cover the transfer of ownership, payment, or pricing of goods but merely regulate the division of responsibilities and costs for goods transportation, loading and unloading, customs clearance, taxes and fees payment, and insurance coverage. As a registered trademark of the International Chamber of Commerce, the Incoterms are recognized worldwide and have become an essential element of international commercial transactions.

If you are looking for assistance with shipping and logistics services and are unsure about the Incoterms rules, please feel free to contact us for a quote. Our team of experienced professionals is here to help you navigate the complex world of logistics and ensure that your goods are delivered efficiently and reliably.